SHIPPING IN THE ERA OF DIGITALIZATION

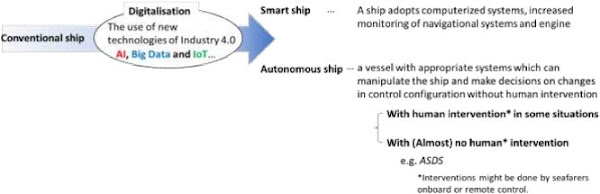

The so-called “Fourth Industrial revolution”, also termed as “Industry 4.0” in the wider literature, is associated with several cutting-edge technologies. Indicative examples in this category are advanced applications like Artificial Intelligence (AI), Big Data Analytics (BDA), Cloud Computing and Internet of Things (IoT), which are already influencing the maritime industry. It is indicative of the fact that there are several construction projects of autonomous ships, such as the Yara Birkeland and the Autonomous Spaceport Drone Ship (ASDS), which are heavily reliant on technologies associated with the Industry 4.0 concept. The maritime transport industry is already transitioning into a new operations paradigm, often termed as “shipping in the era of digitalization”. Shipping companies promote digitalization as the future of the maritime industry and their efforts to set up strategies are already in progress. Examining those visions and strategies in relation to digitalization would be beneficial to better understand the way towards which the maritime industry is heading. This paper is aiming to identify the characteristics of that pool of future plans via a qualitative review and with a particular focus on major maritime commercial actors, based on shipping companies' relevant action plans that were gathered online. A conclusion standing out is that major shipping companies have embraced digitalization to increase cost-efficiency, raise competitiveness and meet the needs of their customers.

The multilevel impacts of the so-called “Digitalization” phenomenon on ships have the potential to completely change the contemporary framework of shipping operations and associated activities. Certain reports imply that the tasks of seafarers are expected to be transformed into more digital ones, such as system management and monitoring of operations, as well as that their operational work may be decreased. The continuous development of information and communication technology (ICT) has enabled a collaborative environment among crew, officers ashore and electronic equipment, both onboard those ships and in the respective supporting facilities ashore. Through those technologies, these designated officers ashore can appropriately understand what is happening in the sea in real time, and safety is therefore increased.

To cope with the challenges associated with digitalization, various entities, including international organizations, States and shipping organizations, such as classification societies, have already responded by developing strategies. A significant number of private companies also promote digitalization, as the future of the maritime industry. Such State-led or organization-led efforts to set up strategies are reported elsewhere. Studying their visions and strategies towards the integration into Industry 4.0 would be helpful to understand the way in which the maritime industry is moving forward and thus, how maritime stakeholders can work together. Among stakeholders in the supply chain, shipping companies play a role in hiring seafarers, operating ships and transporting goods, so their action plans for digitalization will particularly influence the future of shipping.

The impact of digitalization on the maritime sector has been approached mostly from technical, legal and social perspectives in the existing literature. While the literature contributes to identify opportunities and challenges in maritime digitalization, such opportunities and challenges need to be internalized by shipping companies within their strategic directions. It is clear that how individual shipping companies adopt their strategies towards digitalization has not yet been studied. Therefore, it is beneficial to research their strategies and action plans and identify how shipping business is changing through digitalization. Such new knowledge can form the basis for upcoming studies as well as the benchmark for shipping companies that wish to initiate the relevant transformation and reap the benefits of digitalization. Furthermore, there are many stakeholders around shipping companies, such as shippers, shipyards, classification societies and forwarders that will be affected from digitalization, so the identification of the pathway to which shipping companies are going can help these stakeholders to move towards the shared goal and play their own roles for its achievement. States can consider possible regulations for the industry to appropriately use new informative technologies and can also encourage shipping companies to proceed with digitalization through subsidies for research and development of digital technologies in which companies are interested.

Following key technologies as an integral part of Industry 4.0: Advanced Robotics, AI, BDA, Augmented Reality, IoT, CC, Digital Security and Additive Manufacturing. Similarly, other research efforts approach the term digitalization mainly under the prism of changing the prevailing business model and shifting the emphasis towards the creation of more revenues and exploiting business opportunities by using an extended number of digital technologies. This paper defines “digitalization in shipping” as a change in the standard business model by successfully implementing the state-of-the-art technologies associated with Industry 4.0. These key technologies and their expected impacts on shipping can be summarized in the following paragraphs and Table 1 that also presents key features of each technology:

Table 1. The key features of each technology of Industry 4.0.

| Technology | Key features | Authors |

|---|---|---|

| AI | A computer system which can learn from data, recognize correlation between patterns of specific data sets, and finally decide directions of actions with limited (or even without any at all) human intervention The expected application: detection of other vessels or obstacles, collision avoidance, autonomous ship, optimization of commercial or operational activities | Bastiaansen et al., 2019; Lambrou et al., 2019 |

| IoT | A worldwide dynamic network which links uniquely identified physical and virtual objects for communication, configuration and actuation. The expected application: condition monitoring and remote monitoring of critical equipment onboard and tracking/monitoring of cargo activities. | Sullivan et al., 2020; Moræus et al., 2016 |

| BDA | A way to deal with a huge amount of data to find any useful model, pattern, or answer to a question BDA contributes to better service planning, fleet allocation, chartering BDA optimizes ship operation, such as safe and energy efficient operation and schedule management | Ellingsen & Aasland, 2019; Lam & Zhang, 2019; De la Peña Zarzuelo et al., 2020; Ma, 2020; Johansson et al., 2021 |

| CC | Scalable software online, which requires users of only accessible devices and a standard web browser to use it CC provides flexibility, agility, and scalability and can be an economical option to deploy digital service as compared to on-premises model | Xue & Xin, 2016; Sanchez-Gonzalez et al., 2019 Han et al., 2021 |

| Digital Security | efforts needed to protect integrity, confidentiality, and accessibility of data to proceed digitalization One of the hottest technologies in this specific field is Blockchain | Kosseff, 2016; Song, 2021; Balci, 2021a; Yang & Gu, 2021 |

| Blockchain | Blockchain enhances security of transactions The expected application: automation of commercial transactions, such as bills of lading | Balci, 2021a; Petković, 2019 |

| AR/VR | AR provides overlays of information on the surrounding real environment and VR offers a 3D graphics of an environment through head-mounted displays. The expected application: high quality seafarer training with cheaper costs | Mallam et al., 2019; Sharma et al., 2021 |

| AM | transformation from materials to objects from 3D data The expected application: production of ship hull and ship spare parts | Kostidi & Nikitakos, 2018; Sullivan et al., 2020; Kostidi et al., 2021 |

| Advanced Simulation | a virtual model based on real-time data obtained by IoT techniques The expected application: Digital Twin | Sullivan et al., 2020; Fonseca & Gaspar, 2021 |

| Advanced Robotics | enhanced collaboration between workers and robots The expected application: autonomous ship and automation of survey and loading or unloading of goods |

Concept map based on the strategies

The circles in the figure indicate nodes which are areas of interest, objective of digitalization or measures to attain it. The blue nodes are relevant to motives for digitalization, and the brown nodes are related to measures to proceed with digitalization. The red nodes of specific technologies of Industry 4.0 correspond to areas of interest of the shipping companies. Digitalization is a change of ways of business through the cutting-edge technologies of Industry 4.0, so the node ‘digitalization’ (green box) includes the nodes of each technology of industry 4.0, such as AI, IoT and Big Data. Arrows represent relations between nodes. For example, there is an arrow between the nodes ‘AI’ and ‘competitiveness’ with the label ‘increase’. It means that AI increases the competitiveness of the company. The relations between nodes to which more than two companies referred to are shown as bold arrows. The figures next to nodes indicate the number of the companies which referred to the concept in their strategies

Motives for digitalization

the final destinations of arrows (blue nodes) indicate expected results of digitalization, so such nodes are considered to be objectives of digitalization. These are ‘(increasing) competitiveness’, ‘(satisfying) customers’ needs', ‘(increasing) cost efficiency’, ‘(increasing or optimizing) service quality’, ‘(contributing to) environmental protection’, ‘(optimizing) asset’, ‘(improving) marketing’ and ‘(enhancing) education and training’. The node towards which five allows converge is competitiveness. Three companies (Evergreen, HMM and ONE) refer to increase in competitiveness in their strategies through Cloud Computing (Evergreen), AI, IoT and Cyber Security (HMM) and business automation by AI (ONE). The second nodes are ‘cost efficiency’ and ‘customers' needs’, both of which have three arrows. In terms of cost efficiency, three companies (HMM, ONE and OOCL) directly explain in their strategies that specific technology (HMM: CC, OOCL: AI) or digitalization itself (ONE) increase cost efficiency. Hapag-Lloyd's strategy also mentions that digitalization can contribute to sustainable value creation and it may include cost efficiency. CMA CGM did not refer to cost efficiency in its strategy, but this might be because the strategy focuses on the company's efforts to contribute to sustainable development, and the discussion of cost efficiency seems not to match the intention of that strategy. According to Wallgren (2018), the chief information officer of the company should ensure that the company is interested in digitalization because it can optimize its supply chain, and save money, so the focal point is the same as for the other four companies.

Regarding customers' satisfaction, four companies (CMA CGM, Evergreen, HMM and ONE) explained that they will use digital technologies to meet the needs of customers. Specifically, two companies (Evergreen and HMM) mention that introduction of CC will satisfy customers' needs and the other two companies (CMA CGM and ONE) explain that the benefits of digitalization, including container tracking, and real-time freight estimate, will grasp the needs. The other two companies (Hapag-Lloyd and OOCL) did not refer to customers' satisfaction, but they also touch on the above specific technology (faster freight estimate). Therefore, it can be concluded that shipping companies use digitalization in order to reduce cost and raise their competitiveness by grasping the needs of customers. The other nodes, such as environmental protection and assets are specific to the companies because only one or two companies referred to them in their strategies, so these might be differentiations of application of digitalization.

Conclusion

Digitalization in the shipping industry should be viewed as a change in the way of delivering business by introducing cutting-edge technologies of Industry 4.0, including AI, BDA, CC, IoT, Digital Security, AR/VR, Advanced Robotics, AM and Advanced Simulation. A brief discussion of the strategies of the major liner shipping companies for digitalization in terms of motive (why do they try to cope with digitalization?), measures (how do they try to cope with digitalization?) and areas of interest (in which technologies are they interested?) has been conducted. Those major commercial actors have tried to cope with digitalization in order to increase competitiveness and cost efficiency through optimization of assets and to meet the needs of customers, with a very indicative example being provided by container tracking. The concerned shipping companies try to actively collaborate with other companies which have more suitable abilities to take advantage of these cutting-edge technologies. Trending towards open innovation, these companies are of the view that it is necessary to set standards within the industry in relation to digitalization, thus making the most out of it for digital integration among all stakeholders in the supply chain. Change in corporate culture, such as increasing agility, may be also important to cope with digitalization, as one company suggested. This point relates to the promotion of a healthy and realistic digitalized future as an ecosystem for the maritime industry.

In relation to areas of interests, the companies are particularly interested in technologies related to data utilization, such as AI, BDA and IoT. However, no companies referred to radical innovation, such as autonomous ships in their strategies. This might be because different business model is required for autonomous ships and existing shipping companies are not so interested in this field. Rather, autonomous ships may be best suited for newcomers, such as Yara and the Space X. For the time being, smart ships look as a far better fit for traditional shipping companies because they can optimize operation onboard and leverage on the power of a better quality information, in order to enjoy the benefits of cost efficiencies and meet better the diverse and growing customers' needs.

The above findings are mainly in line with results of previous studies, contributing to endorsing them. However, unlike previous studies, the authors did not identify collaboration with customers (forwarders) and cultural change as measures. This might be because of an important limitation of this study: its content is an investigation of only available resources and information from only six maritime companies. As technological changes are being experienced rapidly, a number of follow-up research activities will be needed, but on the positive side this paper at hand can serve as a benchmark for those future studies. In addition, findings of this study imply that it might be necessary for classification societies to develop digital twins and establish certification schemes of AM. Similarly, Flag States might be required to train seafarers who can appropriately use digital technologies.

By Capt.Suresh Jagadeesan

Pondicherry Maritime Academy

Comments

Post a Comment